http://www.dnaindia.com/analysis/column-policy-watch-india-s-huge-crush-on-gold-2020297

India’s huge crush on gold

It does not really matter whether the outlook for gold is bearish (http://www.dnaindia.com/money/report-policy-watch-with-stock-markets-on-boom-bearish-phase-for-gold-not-over-2017007) or even bullish (http://www.dnaindia.com/money/column-policy-watch-bulls-won-t-abandon-gold-easily-it-s-only-a-matter-of-time-2018682) . The one fact that cannot be ignored is that Indians love gold, and will keep buying it irrespective of whether the prices are high, or low.

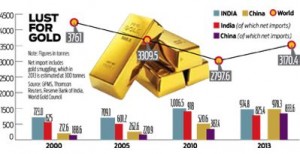

Even a glance at the chart will confirm that. Except for developments during the past two years, India has been the biggest importer of fresh gold in the world. In fact, over the years, Indians have managed to accumulate over an estimated 25,000 tonnes of gold, making it the largest gold depository – though in countless private hands — globally.

The lust for gold

This should drive home just one clear message to India’s policymakers – no amount of policymaking, or import duty structures, will be able to staunch the consumption of gold in India.

This is on account of three reasons. First, the cultural angle. No marriage in India is complete without the exchange of some gold or even silver (which is often called the poor man’s gold). Gold is given as a gift to a child when it is born. And if gold is unaffordable, a silver coin will do.

Second, gold is always viewed as the ultimate hedge against inflation.

Third, there appears to be a very strong co-relationship between a people’s desire to acquire and own gold and their perception of governance. The greater the perception of misgovernance, the more likely will be the increase in the need to own and possess gold. This is true of countries in the Middle East, in Asia and in Latin America. That could explain why many countries, which have been witness to major gold rushes, have seldom become gold owners. People there extract gold, and then sell it promptly. The capital is used for pleasure or for commerce. But the lust for ownership is missing.

That should also tell the Indian government something – that if it wants to reduce the average Indian’s lust for gold, it must first try and improve on how people perceive it – convince them that it is capable of good governance.

The best proof of misgovernance

The best testimony to misgovernance is the manner in which the government has turned a blind eye to the rampant prevalence of adulteration of gold and silver.

Ask any gold or silver refiner in the country, and he will tell you that almost 75% of silver coins which bear the images of gods and goddesses are made up of adulterated silver. In fact, the silver component is not even half the weight of the coin. Contamination of gold is usually to the extent of 10-20% of the purity of gold. Except for a very few brands (Tata’s Tanishq is a glowing example) most gold sold by jewellers is of a lower purity than what is claimed.

For the past 70 years, consumer and trade organisations in India have been begging the government to introduce and enforce hallmarking of gold and silver. However, even today, the practice is often in breach of this global principle.

Make local availability of gold easier

The only way the government can actually slow down import of gold is by allowing locally stored gold to come out into the domestic market. The government must create policies that encourage all gold investments, especially gold bars, biscuits and coins, to get deposited with Indian banks. Obviously, this means allowing for a variant of gold bonds to be introduced in the markets once again, where a gold (or silver) depositor can be guaranteed return of his gold, volume for volume, after say a period of five years.

To get this investment gold out in the mainstream, it must be allowed to earn at least a 1% rate of interest per annum. To enable the banks to pay this rate of interest, they must be allowed to offer this deposited gold to the Indian market at a markup of say 2-3%.

That would make gold available from banks more attractive than gold imported from overseas which continues to attract a duty rate of 8%.

To augment Indian banks’ gold holdings, allow designated Indian banks (not the state owned MMTC which has a history of unaccounted transactions) to import duty-free the quantity of gold that they have on their books as gold deposits from time to time. It would thus be a variant of the Replenishment Export Permits (REPs) which once became the lubricant to galvanise India’s exports. Turkey has done something similar, with some incredible results (http://www.dnaindia.com/money/report-policy-watch-here-s-what-fm-could-learn-from-turkey-about-gold-1962499 ). India should do the same.

This way, the banks earn some money, import of gold slows down because of easy availability of domestic gold (which has remained locked away in vaults). Most importantly, the jewellery trade which employs some 35 million people, can become more vibrant with the easy availability of this precious metal.

Since banks would have to work in conjunction with gold (and silver) refiners, hallmarking of gold becomes easier. Precious metal refiners too will begin to prosper and become increasingly relevant, and India could actually think of becoming a gold trading centre in the world. If India does not do this, the gold hub might move from Dubai to China.

Most importantly, such a policy would reduce smuggling, because a 2-3% markup on the international price provides no incentive for smugglers. But an 8% duty structure is actually an invitation for this kind of undesirable practice. It explains why almost 300 tonnes of gold got smuggled into India last year (though some finance ministry officials foolishly believe that it could not be more than 30 tonnes).

The longer smuggling continues to be attractive, channels of this underground trade are likely to become more streamlined and robust. Sooner or later these channels will be used to smuggle in drugs and even arms. That is why smuggling of gold needs to be made less attractive. Urgently. Higher import duty rates encourage smuggling. Opening up the domestic market with domestically available gold at low markup rates could change all that.

COMMENTS