http://www.dnaindia.com/money/1906450/column-policy-watch-p-notes-the-big-money-laundering-machine

P-notes: The big money laundering machine

Monday, Oct 21, 2013, 9:54 IST | Agency: DNA

On August 1, 2013, the Reserve Bank of India (RBI) instructed foreign institutional investors (FIIs) which were seeking to hedge forex exposure relating to participatory notes (P-notes) to take prior permission from note holders before doing so.

On August 1, 2013, the Reserve Bank of India (RBI) instructed foreign institutional investors (FIIs) which were seeking to hedge forex exposure relating to participatory notes (P-notes) to take prior permission from note holders before doing so.

Not-so-surprisingly, the rupee rebounded sharply.

The RBI notification compelled banks and investors to cut their dollar positions. Curiously, nobody in the policy circles probed further. It was as if everyone knew that some FIIs had been short-selling the rupee in non-deliverable trades without prior formal sanction from P-note holders. It was as if someone powerful in the government had given them the go-ahead, confident that nobody would intervene. That is, till the RBI decided to pull the plug. P-notes were prevented from eroding the rupee.

But what are P-notes?

The story goes back to 1992, when the Securities & Exchange Board of India (Sebi) — to shore up India’s rapidly vanishing forex reserves — permitted FIIs to register and participate in the Indian stock market. Somewhere, sometime, the government decided on a derivative instrument called P-note, which was available to Indians only; but for those with foreign exchange that they could deposit with any FII overseas. In lieu of the money, the Indian would get a P-Note, which the FII could use to invest in Indian markets.

Since all these investments came through the Mauritius route, all speculative earnings that could attract a tax rate of 30% could be now converted into forex and repatriated tax-free. Thus, while resident Indians had to pay tax, P-note transactions (by Indians through FIIs) were exempt.

That was not all. Somewhere, sometime, the government also decided that depositors of money with FIIs did not have to follow KYC norms. Thus, while any resident Indian must prove his identity before investing in shares and mutual funds, a P-note holder is exempt. He could thus use ‘black’ money, yet earn ‘white’ money on it, tax-free, protected by the government. What a brazen money laundering mechanism!

But it wasn’t so all the time. In 2005, in the Sebi versus UBS case, Sebi said that UBS had violated Section 15 (A) of FII regulations which stated that “A Foreign Institutional Investor or sub-account may issue, deal in or hold, off-shore derivative instruments such as Participatory Notes, Equity Linked Notes or any other similar instruments against underlying securities, listed or proposed to be listed on any stock exchange in India, only in favour of those entities which are regulated by any relevant regulatory authority in the countries of their incorporation or establishment, subject to compliance of “know your client” requirement.”

In fact, even earlier, in the Joint Parliamentary hearings (Para 8.81) the issue of the unwelcome role of P-notes in India was discussed. In the Action Taken Report, it was pointed out how organisations like “Citi Group and Goldman Sachs have issued Participatory Notes to banned entities such as CSFD and overseas corporate bodies. . . . Is it not true that Participatory Note holders are not disclosing their identity?”

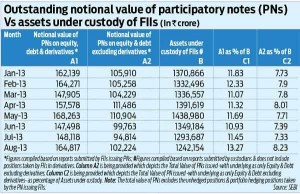

P-Notes accounted for at least Rs 164,817 crore (around $27.5 billion) out of Rs 1,242,154 crore ($207 billion) of assets managed by FIIs (see table).

But according to an expert group appointed by the finance ministry in August 2004, P-notes form about 46% of the cumulative net investments in equities by FIIs. Some like Subramaniam Swamy say that almost two-third of FII investment is through P-notes. That makes a mockery of the Supreme Court’s directive to the government to track down all benami account holders. If the above numbers are true, much of the black money is already in India through the P-note route, earning higher (tax-free) rates of return than if it were parked in Swiss banks.

Not surprisingly, just last week Sebi tightened rules. Now, FIIs will have to report monthly details of P-note based transactions within 10 days. But the insistence on KYC compliance has not been enforced. Clearly, the laundering machine is still open for business.

COMMENTS