https://www.freepressjournal.in/analysis/is-india-headed-for-further-currency-depreciation/1470652

Unproductive spending could easily lead to further currency depreciation

RN Bhaskar February 28, 2019

Turning and turning in a widening gyre//The falcon cannot hear the falconer.//Things fall apart, the centre cannot hold . . . . .

WB Yeats, The Second Coming

The lines by WB Yeats are prescient. There is a danger of things falling apart in India.

Last week saw the Reserve Bank of India finally agreeing to transfer Rs.28,000 crore as interim surplus to the government of India. Normally, the RBI keeps this money with itself for market operations. It injects or sucks out cash as required to calm markets. The transfer of funds as an interim measure could crimp the RBI’s ability especially in volatile times like these.

Then watch how, in February 2019, seven PSUs concertedly went in for a buyback spree to help the government – their biggest shareholder – meet its asset-sale targets. Collectively, they will be transferring around Rs.17,000 crore ($2.4 billion) to the government. That money could have been used to fund the expansion programmes of the PSUs. Some of them include companies like Coal India, NHPC and NMDC. It must be added, however, that this amount is still lower than Rs.54,500 crore that the government transferred to itself last year.

Then watch how, in February 2019, seven PSUs concertedly went in for a buyback spree to help the government – their biggest shareholder – meet its asset-sale targets. Collectively, they will be transferring around Rs.17,000 crore ($2.4 billion) to the government. That money could have been used to fund the expansion programmes of the PSUs. Some of them include companies like Coal India, NHPC and NMDC. It must be added, however, that this amount is still lower than Rs.54,500 crore that the government transferred to itself last year.

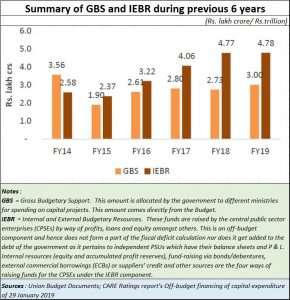

But then these transfers are in addition to the ones listed above. Such financing had already crossed all previous limits by January 2019 (see chart). And this is where the problem begins. By keeping its own books clean, the government claims that it has managed to limit its borrowing to the stipulated ratios – especially the CAD (current account deficit). But the off-budget transfers highlight the distorted picture the government has conveyed to its people. If a company had done this, the Company Law Board would have thrown the book at it.

There is another problem that people often forget. It is easy to push up GDP growth through borrowed funds. A government can borrow (or take) money, get people to dig wells, and then use money and pay people to fill up the same wells. The payments made to people gets reflected as GDP growth. But the ‘assets’ for which the amounts have been spent are unproductive. As a result, you have injection of funds, without a corresponding increase in productivity.

The consequence is inflation, and then currency erosion. There are fears that this could be happening now. Moneymarket punters who were betting three months ago that the rupee would slide to Rs.75 to a US dollar, and now betting that it could slide further, maybe up to Rs.85 a dollar.

When governments announce freebies and schemes which do not contribute to productivity, the danger of inflation and consequent currency depreciation is always round the corner. The money which could have been used for augmenting production, or making processes more competitive, or even creating jobs, have now been used up in doles and schemes which are not productive.

Take for instance the grant of Rs.6,000 crore per farmer household per year. This PM-Kisan scheme is to be extended to 1 crore farmer-households who have small holdings. That means an outgo of Rs.2,000 per household in the first tranche which amounts to Rs.2,000 crore right away. Nothing wrong with that. But if the government had instead allowed them to get cows, goats, or layer hens instead – through coupons issued by and redeemed by designated banks – that would have been money for a productive asset. They could have helped farmers earn more. Cash by itself may not amount to anything.

But then, there is also the problem with a section of the political class which abets vigilantism against those who give old cattle away (http://www.asiaconverge.com/2018/05/cattle-slaughter-ban-missteps-may-factor-bjps-electoral-woes/). You cannot have farmer prosperity and such vigilantism side by side. One of them has to be stopped immediately. Progressive governments would have unhesitatingly shown a zero-tolerance towards vigilantism.

In India, however, it needs the courts to tell this to the lawmakers. And the decision by a Congress ruled Madhya Pradesh to slap the provisions of the dreaded NSA (National Security Act) against cattle traders only highlights the retrograde measures (and thinking) that are being promoted and put in place. Expect doles to farmers to yield a bitter harvest, as farmers begin to lose their best sources of income (http://www.asiaconverge.com/2019/01/nothing-quiet-farm-loan-waiver-front/).

This is true of business as well. “The Banning of Unregulated Deposit Schemes Ordinance, 2019” promulgated on 21 February 2019 is another instance (https://www.freepressjournal.in/india/sweeping-law-bans-all-kinds-of-ponzi-schemes/1466675). Though aimed at curtailing Ponzi schemes, the Ordinance is no poorly drafted, that it renders illegal any lending or borrowing among friends or communities.

Poorly drafted legislation, terribly conceived bans, vigilantism, and the splurge of freebies, are likely to further erode India’s currency.

Sadly, the tea leaves do not have a happy story to tell.

COMMENTS