http://www.moneycontrol.com/news/business/economy/some-red-flags-in-the-economy-numbers-agriculture-is-the-most-alarming-2477189.html

Economic growth continues to falter. Watch agriculture

When agriculture’s GVA growth climbed from -0.2% in 2014-15, to 0.7% in 2015-16, everyone expected agriculture to continue doing well. This was confirmed by this growth rate further rising to 4.9% in 2016-17. But what happened now?

RN Bhaskar — Jan 07, 2018 04:05 PM IST

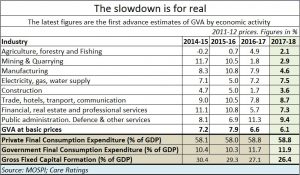

So it is finally official. The fears that most people had kept suppressed – about India witnessing an economic slowdown – have been realised. The Central Statistical Office (CSO) came out last week with its latest figures, which are the first advance estimate of Gross Value Added (GVA) by economic activity.

Agriculture slips

Overall, GVA slipped from a growth of 6.6% last year to 6.1% this year. Last year’s growth was itself a climbdown from 7.9% (see chart). But what was most worrisome was that the growth rates in agriculture were hit. Agriculture was meant to be the main focus area for the present government. Hence, when agriculture’s GVA growth climbed from -0.2% in 2014-15, to 0.7% in 2015-16, everyone expected agriculture to continue doing well. This was confirmed by this growth rate further rising to 4.9% in 2016-17. But in 2017-18 it slipped back to 2.1%. What happened?

Overall, GVA slipped from a growth of 6.6% last year to 6.1% this year. Last year’s growth was itself a climbdown from 7.9% (see chart). But what was most worrisome was that the growth rates in agriculture were hit. Agriculture was meant to be the main focus area for the present government. Hence, when agriculture’s GVA growth climbed from -0.2% in 2014-15, to 0.7% in 2015-16, everyone expected agriculture to continue doing well. This was confirmed by this growth rate further rising to 4.9% in 2016-17. But in 2017-18 it slipped back to 2.1%. What happened?

There could be three reasons for this.

First, in the cash-based economy, it is possible that demonetisation (actually the withdrawal of high-denomination currency notes of Rs.500 and Rs.1,000) itself was the culprit. It threw sand in the wheels of rural commerce.

The second possibility could be that the law of unexpected consequences was making its relevance felt. The cow slaughter ban, extended to the transportation of buffalo meat, could have hurt agriculture. Remember, the fastest way to rural prosperity is through cattle farming and other kinds of animal husbandry. What might have worked for hardcore Hindutva regions like Uttar Pradesh and Haryana did not work very well for other parts of the country. When a man purchased a cow or a buffalo it was with the clear objective of making money. Thus when a cow or a buffalo stopped procreating, hence lactating, the farmer had no option but to sell off this animal. It often ended up in the slaughterhouse.

The second possibility could be that the law of unexpected consequences was making its relevance felt. The cow slaughter ban, extended to the transportation of buffalo meat, could have hurt agriculture. Remember, the fastest way to rural prosperity is through cattle farming and other kinds of animal husbandry. What might have worked for hardcore Hindutva regions like Uttar Pradesh and Haryana did not work very well for other parts of the country. When a man purchased a cow or a buffalo it was with the clear objective of making money. Thus when a cow or a buffalo stopped procreating, hence lactating, the farmer had no option but to sell off this animal. It often ended up in the slaughterhouse.

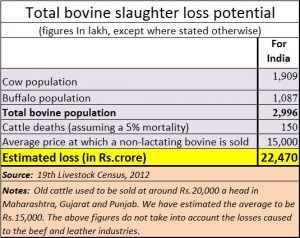

The farmer got around Rs.20,000 per cattlehead, which he used to subsidise the purchase of another milch cattle for Rs.50,000 or Rs.60,000. When he could not get this amount, he postponed the purchase of a new animal. This is because he had to contend with the additional expenses for food and medicine for the old cow/buffalo. So was this the cause for the decline?

According to this author’s calculations, the loss to the farmer community alone could be around Rs.22,000 crore a year. Assuming that 50% of the cattle was not affected – because states like Tamil Nadu, Kerala, Andhra Pradesh and those in the Northeast sensibly refused to enforce this ban – the farmers could have collectively lost Rs.11,000 crore. And this does not cover the additional losses on account of food and medicine for the cattle that continue to grow old and could not be disposed of.

According to this author’s calculations, the loss to the farmer community alone could be around Rs.22,000 crore a year. Assuming that 50% of the cattle was not affected – because states like Tamil Nadu, Kerala, Andhra Pradesh and those in the Northeast sensibly refused to enforce this ban – the farmers could have collectively lost Rs.11,000 crore. And this does not cover the additional losses on account of food and medicine for the cattle that continue to grow old and could not be disposed of.

Third, there were other losses as well. The above loss does not include the losses suffered by two industries – leather and beef.

Third, there were other losses as well. The above loss does not include the losses suffered by two industries – leather and beef.

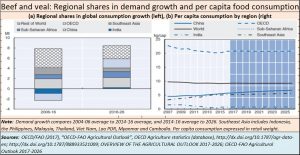

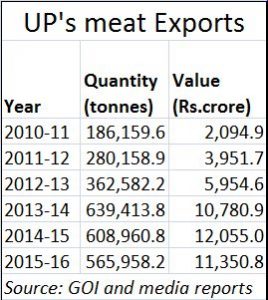

Since India accounts for the largest population of cattle in the world, it was obvious that India would also be one of the largest exporters of beef – since the domestic market for beef is limited. The ban relating to cattle slaughter and transportation could have affected at least half this number causing exports to plummet. That could also have affected employment. Do bear in mind that India remains the third largest exporter of beef after Brazil and Australia. In fact, ADB data (http://www.fao.org/3/a-i7465e.pdf) makes special reference to India’s position in the global market for beef and veal (see chart).

The hide of cattle that is slaughtered goes to the leather industry. The losses suffered by this industry cannot be estimated. This is because the domestic industry is largely unorganised and is huge. Moreover, the hide of animals that die because of natural causes can still be used (though it is often of poorer quality because of disease and age). This sector is also one of the largest exporting industries from India. And it employs millions of people. It is possible that the ban on animal slaughter and transport would have affected this sector as well.

Reduced employment would have resulted in lower purchasing power. That could have slowed down the agricultural economy.

There was also the problem with farmer distress. This was caused not only because of unseasonal rains, but also because of reckless imports. Such imports depressed domestic prices – especially for pulses. Someone in the agricultural and commerce ministries had clearly goofed up. The government has yet to come out with the reasons why such imports were resorted to – especially since data on the increased acreage under pulses growth was already available (http://www.asiaconverge.com/2017/05/how-pulses-imports-drove-domestic-growers-to-the-ground/) .

The case of mining

Interestingly, the mining sector witnessed an upturn. It had been declining from 11.7% in 2014-15, to 10.5% in 2015-16, to 1.8% in 2016-17. But in 2017-18 it climbed to 2.9%. Something appears to be happening here.

Interestingly, the mining sector witnessed an upturn. It had been declining from 11.7% in 2014-15, to 10.5% in 2015-16, to 1.8% in 2016-17. But in 2017-18 it climbed to 2.9%. Something appears to be happening here.

Two explanations are possible. First, the Supreme Court’s order demanding that all mines be auctioned did stop a lot of reckless mining, and the export of mining produce from India. But the higher payments for the mines allowed Indian mining products to discover new price levels.

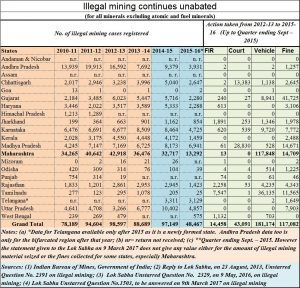

And illegal mining continues unabated (see chart). And Maharashtra tops the list. It is this chart that shows that much of the hue and cry about illegal mining in Karnataka and Goa were not really justified. Maharashtra should have been investigated first. And this continues even after the present government came to power.

How lucrative is illegal mining? Extremely so. It may be worth recalling that when the Saradha chit fund scheme was unravelling, CBI sources revealed that almost Rs.1,000 crore had been invested in illegal mining companies in the North East. Significantly, the data presented before the Lok Sabha (see chart) does not give any data for the North East, which remains the most lucrative area for illegal mining. In fact, recent reports of Naxalites blowing up weigh bridges suggests that it is the illegal miners who goad the Naxalites into blowing up anything that could be a threat to their industry.

Other worrisome signs

As a CARE Ratings report of January 5, 2018 (GDP growth: Advance Estimates FY18) points out, “The investment rate measured as the ratio of gross fixed capital formation to GDP at current prices is expected to decline further to 26.4% this fiscal from 27.1% last year and 34.3% in FY12. This indicates that corporates have not been investing in capital creation this year. A pick up private investment is essential for a rise in overall investment rate.”

That may be difficult. The investment climate is not very good. Many foreign investors are still chafing over the Indian government’s plans to prevent foreign companies (and Indian companies) from going in for international arbitration with a seat overseas. The latest in this battle is Japan’s Nissan, which wants to challenge the government’s decision to tax its profits. It wants to go in for arbitration overseas. The government does not want to permit this. The battle continues (more on this later).

Finally, as the CARE report points out, “Only 4 sectors from the services segment are projected to see growth rates above 7% . These are electricity & utility services, trade , hotel ,transport & communication services, Financial, real estate and professional services and social services. These sectors together account for around 57% of the GVA.” So, India may have to contend with a hobbled growth in the coming year.

It is quite possible that some of these issues will get sorted out in the forthcoming budget. Meanwhile, political compulsions have already forced the government to ease the slaughter and transportation ban.

It is aware of the Supreme Court’s annoyance at the imposition of these bans which interfere with the basic liberty of people to eat what they want or to practice a trade.

But more interestingly, the emergence of the Dalit vote bank as a formidable force across in the country (the recent upheavals in Gujarat and Maharashtra are testimony to this fact), will possibly galvanise them to partner with the Muslims to demand the abolition of the ban that has appealed to the hardcore Hindutva votebank of the government. Developments on this front will be most interesting to watch.

COMMENTS