http://www.freepressjournal.in/analysis/the-urgent-need-to-tax-agricultural-income/1186437

Taxing agricultural income is sorely needed

— By | Dec 14, 2017 07:15 am

In November 2017, the IMC Chamber of Commerce and Industry came out with a white paper on Taxation of Agriculture Income in India.

It makes a compelling case for taxing agricultural income in the country. The white paper points out the following:

It makes a compelling case for taxing agricultural income in the country. The white paper points out the following:

- Since independence, agricultural income has been exempted from income tax.

- After 70 years of Independence, some farmers and corporates have substantial income which is not taxed.

- In AY 2015-2016, 307 individuals reported agricultural income of over Rs 1 crore.

- A company in AY 2014-15 reported agricultural income of Rs 215 crore.

- Between AY 2006-07 and AY 2014-15 (9 years) there were 2,746 cases when excess income from agriculture of Rs 1 crore was declared.

- This has also become a loophole to convert black income into white.

- Any agricultural income in excess of Rs 5 lakhs per acre should be subject to scrutiny.

- To widen the tax base, sooner or later, agricultural income will have to be taxed. At present, the union government cannot tax agricultural incomes, only the states can. Eight states have levied agricultural income tax at some point of time or the other in the past.

- Hence, it is proposed that the union government should consider taxing agricultural income in the hands of:

- Individuals having agricultural income in excess of Rs 1 crore, and

- Corporates

- It is estimated that tax in excess of Rs 25,000 crore can be collected, if the above suggestion is accepted.

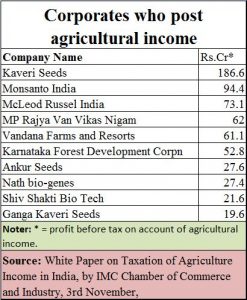

The white paper also lists out some companies which have shown agricultural income on their books and have thus benefitted from tax free income (see chart).

In fact this column has been advocating a similar line because much of the moneylaundering in India takes place through the agricultural income route. In India, therefore, agriculture is also a laundromat. A very good example was the manner in which powerful people are believed to have tried to claim as much as eight times India’s GDP as agricultural income (http://www.asiaconverge.com/2017/11/agricultural-income-and-black-money/).

At times this ill-gotten money is even used to finance terrorism (http://www.asiaconverge.com/2017/11/agricultural-income-and-black-money/ ) either in Jammu & Kashmir or in Naxalite-infested regions. The easiest way to stanch such diversion of funds is to bring agricultural income under the tax purview. Currently, anyone earning over 20 lakh of income – irrespective of whether the source is agriculture or not – must enter the financial data himself while filing his income tax returns. While filing of returns for such people is compulsory, taxation on agricultural income is not. It is tax free. That allows some people to gain benefits that common people don’t get.

The IMC white paper recommends that anyone earning an income of more than around Rs.1 crore should be taxed. That too is quite generous. Typically, a household will then claim an income of Rs.1 crore in the husband’s name, another Rs.1 crore in the wife’s name and another Rs.1 crore as an HUF (Hindu Undivided Family) if the family is Hindu by religion. And if the children are over 18 years of age, each could benefit from tax free income of Rs. 1 crore. This author believes that a maximum of Rs.50 lakh per head should suffice. That is quite a large amount of money, especially for people living in rural areas.

The author is in full agreement with the IMC white paper that companies earning income through agriculture – through plantations, or farms – should also be subject to tax.

The need to tax agricultural income in India has always been an issue that has appealed to the overburdened taxpayer and to the economist. But the concept has been shot down time and again by politicians who see agriculturists not merely as a vote bank. They view agriculture as a laundromat which can allow the powerful to convert their ill-gotten earnings into legal currency. Could that explain why the government constantly comes up with statements assuring everyone that agricultural income will not be taxed?

The situation becomes murkier when one considers that the PIL filed in Patna High Court almost 5 years ago remains unheard till today. The petitioner (a retired income tax officer named Vijay Sharma) requested the court to direct the government to make public the names of parties which have claimed agricultural income. According to the petitioner’s sources the total agricultural income claimed by some 6 lakh assessees – between 2004 and 2013 — would be in the region of Rs 2,000 lakh crore. Figures compiled by this author for just three years totted up an amount of Rs 865 lakh crore.

Sharma had first filed an RTI (Right to Information) request with the income tax department for this information. That was denied. He therefore decided to file a public interest litigation (PIL) petition with the Patna High Court in Bihar. This matter was duly reported by media in March 2016. The court was supposed to hear the petition in April in that year itself. But the courts, too, have been silent on this matter.

The income tax department’s refusal to declare the returns filed by assessees as being bogus is equally curious. But there could be a good explanation. If the returns filed by such assessees are declared as being flawed, they would be subject to prosecution for filing wrong information. After all, anyone having an income of over Rs.20 lakh has to feed the figures on the Income Tax web page himself. Prosecuting powerful people could be tricky. At the same time, the Income Tax Department is also unable to accept the returns as being a true reflection of incomes. Should that be done, India would have to revise its GDP as being eight times higher, with attendant demands for verification.

One sensible way out is to pass a law which permits agricultural income to be taxed. But will the government do this?

COMMENTS