http://www.freepressjournal.in/business/fpj-imc-forum-indian-food-processing-sector-is-still-processing/1152153

Food processing — the new gold mine

— By | Oct 12, 2017 09:29 am

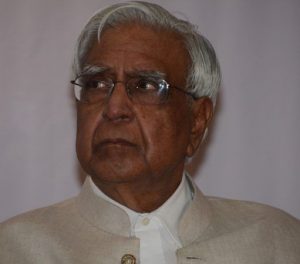

Last year, Prime Minister Narendra Modi had set an ambitious target of doubling farmers’ incomes by 2022 with the spotlight on the food sector and its growth potential. Food processing takes the sector equation beyond mere output growth to value-addition, stability, job creation and sustained prosperity. The Free Press Journal (FPJ) organised a panel discussion on the topic ‘Food Processing: The new goldmine in India’, jointly with the Indian Merchants Chamber (IMC) and moneycontrol.com as the digital partner. Panelists for the panel was Dilip Rath, Chairman of the National Dairy Development Board; Anantha Padmanabhan, MD, Alfa Laval and Cluster President, India, Middle East & Africa and Neelkanth Mishra, MD, India Equity Strategist at Credit Suisse. The welcome address was given by Lalit Kanodia, IMC President, as was the vote of thanks. The panel discussion was moderated by RN Bhaskar, consulting editor, FPJ, with editorial support from Pankaj Joshi.

Lalit Kanodia: Food processing is extremely crucial to India – agriculture sector today constitutes around 15 per cent of GDP but provides employment to about 60 per cent of our working population. So it is no rocket science that per capita income of people occupied in this activity is pathetically low. So we have farmer suicides, a national shame in my view, and we have governments writing off loans.

The finance minister has bravely promised that he will double farmer income in five years. So how do you do this? First, of all our farm productivity itself is extremely low, maybe 60-70 per cent of the global average. 50 per cent of our land is not irrigated, which means that area has only one crop in a year instead of two or three. On one side we don’t have irrigation, on the other we have 50 per cent of India’s river waters going into the sea. We cannot build dams, because there is a huge social problem, displacement and unrest.

Then the answer is productivity – better seeds and more fertilizers hopefully organic. If fewer people do the same production, obviously their per capita income will go up. For that you need urbanisation, more jobs and skill training, it is a complex issue to address. The panel here would discuss one of the aspects – how to go up the value chain and what can food processing do to increase the income of the farmer. Food processing is in fact a bridge which links agriculture and industry. This activity provides 80 per cent gross value addition in both manufacturing and in agriculture, and has enormous export potential.

Food processing is a win-win situation. First, it provides you with better quality of food and more nutrition. Profit from the food processors are employment generation. An estimate says that the job creation potential is of 9 million jobs, which is massive if you compare it with IT sector which is about 3.5 million jobs. Then there is more income for farmers. There is enhanced food security, since processed food can be stored for longer periods of time.

I think the sector is doing a great service. I am really looking forward to your discussion. So let me hand it over to Mr. Bhaskar to take over.

FPJ: As the President just mentioned, when 50 per cent of the people producing only 14 per cent of India’s GDP, the normal answer is that either people leave agriculture or prices of agriculture produce go up. The third alternative is to enhance the sector output value of agriculture without increasing prices and take away need for people to migrate. If that solution has to work, it has to work only with the food processing industry. We have three stalwarts here and I would like to begin the session by inviting Mr. Anantha Padmanabhan who represents Alfa Laval, one of the largest players in food processing in the world.

Anantha Padmanabhan: Alfa Laval has been in food processing since inception. Our founder, Gustaf de Laval, invented the first cream and milk separator. Today’s topic revolves around opportunities and if food processing is a gold mine? The question is whose gold mine is it? Do we have the farmers in mind or economic sustainability when we talk about a gold mine?

Dr. Kanodia very rightly said that the food processing industry is a bridge. My personal view is that we should make this bridge much shorter. So that the processing gets much closer to the producer. We can take a leaf out of the White Revolution, which Dr Kurien launched many years back. There processing was taken close to the farmers that brought about a dramatic change in their quality of life, as well as in the availability of milk in the country. It also helped the industry bring in new processing technologies to add value to the basic product. We at Alfa Laval are very proud to have been associated with this industry. In 1985 when I started my work at Alfa Laval, one of the first projects where I worked was the installation of a chilling centre close to Bhubaneswar, which Alfa Laval supported and worked with NDDB to install.

Alfa Laval has developed technologies worldwide and brought them to India. India today is a competence hub for Alfa Laval worldwide in food processing. However, it is a disappointment that we have not yet fully absorbed the technology to develop the quality of production and product variety, compared to our neighbours like Sri Lanka and South East Asian countries. The food processing sectors there produce very high quality of food and are quite export-oriented, which means that the domestic markets there also access high-quality products.

I would emphasis on two things. First, we need to bring the processing industry much closer to the producer and second, we should open up the market for new technologies which will add value to the products and make them of international quality, which will also open up our opportunities for export market.

FPJ: I now request Dilip Rath to give us his views.

Dilip Rath: Today we are discussing how to rejuvenate the farm sector profitability, employment incomes of farmers and bring about all-round prosperity in the rural community. I represent the National Dairy Development Board, which brought about the Great Indian Milk Revolution in the 1960s post the food crisis and which played a substantial role in us becoming self-sufficient in milk.

Today I will focus on investment opportunities in the dairy processing sector. India continues to be the world’s largest producer and consumer of milk today. We have been growing at 4.5 per cent annually for the past ten years and we expect the same to be maintained over the coming decade. We have a large domestic consumer base and demand is growing fast.

On the demand side, our market is among the largest in the world. We are looking at a demand surge likely to take place across the entire range of dairy products in the coming years. Surge both in traditional products as well as new and futuristic products like dairy based wellness products, nutraceuticals, specialised health and functional products.

On the supply side, there are programmes and systems in the field to enhance productivity of our milch animals, so that supply can keep pace with the increasing demand. We all know that a significant part of the milk produced is retained in the villages. We also know that a significant part of production is handled by the unorganised milk vendors. Between these two, the situation is that only 17 per cent comes to the organised processing sector and the untapped potential even today is huge. Even today we are present only in 50 per cent of India’s six lakh villages. Many of these have huge production potential and we still have huge untapped areas where we could go and start village milk procurement operations and get the milk supplies growing.

We ourselves were surprised when we went to backward areas in Vidarbha, Marathwada and Jharkhand, and got a tremendous response from producers who came forward and improved their small milch herds and started pouring milk into the procurement system. We found that once market access is given, milk starts flowing. In short, rising demand and the scope of accessing regular milk supply both have opened up huge opportunities for the Indian dairy industry to expand, modernise and refurbish their capacities. We estimate a rise of 60 per cent in organised procurement in the next five years.

Processing-wise, many dairy co-operatives have now the problem of replacing their ageing infrastructure, built during Operation Flood times. Dairy is also looking at new technologies, which would save energy and be more efficient in terms of water and power consumption and complying with the food laws, all of which would require investment in processing infrastructure. In conjunction with the projected increase in supply, this means there is an investment requirement of Rs16, 000 crore. Our estimates are that the dairy industry needs to create additional capacities of about 500 lakh litres of milk per day, addition, which will definitely need that kind of money.

For co-operatives, the Government has recently announced a new scheme, Dairy Processing & Infrastructure Development Fund with a total outlay of Rs 10,800 crore, for cooperative enterprises to invest in expansion and refurbishment of processing capacities over the next three years. It will be channelised through NABARD and NDDB. The rate of interest would be 6.5 per cent, with a subsidy component too. Since cooperatives pass on about 75 per cent to 80 per cent of the consumer rupee to the milk producer, this investment will see tremendous benefits flow to producers. It will help create huge employment and income opportunities in rural areas.

Coming to private processing sector, there also we see a lot private processors making investment into capacities. Although, there are reports which state that private processors in aggregate have under-utilised capacities, and also they have not invested in connecting with the farmers in the villages and in transparent and fair milk procurement systems. However, there are also many private processors which have invested in setting up village level procurement infrastructure like cooperatives, and we see lot of growth taking place within these areas in the future years.

In terms of the prospects of food processing in general and dairy processing in particular, the Government of India has also announced another new scheme called Kisan Sampada Yojana. A provision of Rs 6,000 crore is for a seed fund, which can leverage a total investment about Rs 30,000 crore. This will see huge benefits coming to producers, processors and consumers. With all these opportunities, we really do see that food processing is a goldmine for all the stakeholders involved, starting from growers, as farmers, processors, the consumers and technology suppliers, service providers, entire range of people who will get involved in this surging economic activity in the coming years. .

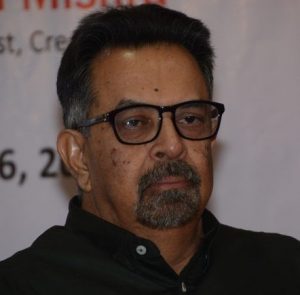

FPJ: Can I request Mr. Neelkanth Mishra to speak? We thought it would be good to call him because he is a trained market analyst and nothing really moves the economy as much as investments and market sentiment and market knowledge.

Neelkanth Mishra: It’s a privilege to be here. From the perspective of the broader economy I believe food processing is critical to agriculture and informal employment. I will just run through five key transformative changes that have happened, or are happening in the Indian economy.

The first key change is that, we are now a food surplus nation. We are seeing sustained surplus across categories. You may recall the 2010-11 episode where Food Corporation of India had warehouses overflowing with rice and wheat because of which some was stored in the open and there were issues of rats and fungus growth etc. That was a clear sign of having too much production. Our demand for potatoes is 27-28 million tonnes and we produce around 48 million. We can produce even more if price incentive is there. The milk story is of course well known, courtesy the NDDB we are creating a huge volume growth in milk.

Now the real issue is the marginal growth in food demand. Food demand beyond a point does not grow, because the incidents of abject hunger the per capita calorie demand in India has been falling for the last several decades.

With slowdown in population growth, calorific need is not growing. Against that, with better infrastructure and better technology, the farmer has access to more information, and farm productivity is actually rising very rapidly. So unless we know what to do with the surplus, it will be impossible to prevent farm prices from falling. For 2004-14 we had a farm income growth of 13.5 per cent a year, and the last four years have seen single digit increases. Now that could be a political risk and an economic risk. The only way you can deal with surplus food is to export it and for that you have to process it.

The second big change is electrification. Dr Rath mentioned that 60 per cent of milk produced in India does not leave its village. The primary reason is that it is not viable for farmers to carry it out on kaccha roads – time, spillage, spoilage (no chilling) and so on. Even in 2011, only 68 per cent households had access to wires, and the percentage of households that had more than 12-14 hours of electricity was much smaller. Today, even in UP and Bihar, villages have 20 plus hours of electricity. Percentage of households accessing electricity is now above 85 per cent and the target, from the Saubhagya scheme, is to push it to 95-100 per cent by December 2018. Electricity supply allows the farmer a lot more freedom to chill things and to process things in a small way.

Third big change is roads in last 15-20 years. We have built nearly five lakh kilometres of rural roads which does not get media attention. Their capex needs are marginal (Rs 40lakh/km) against a National Highway road (Rs15 crore/km). With this small capex, India has connected 200 million people in 1, 10,000 villages to the mainstream economy for the first time in history. That allows a lot of vegetables and milk to get evacuated. It allows villages to join the economic mainstream, which is a very transformative change. Fourth big change is the availability and accessibility of finance for free India—from what I call a vicious cycle of small enterprises. There are nearly 6 crore micro enterprises with an average employee strength of two. These don’t save enough, they are mostly informal with no credit access and do not know how to grow.

Now with increased digitisation and increased bank accounts, issuing credit has actually become much cheaper. Loan processing with manual evaluation, would cost Rs 500-1,000 and a large scale project evaluation could cost lakhs. With data-based evaluation, this cost can come down to Rs 20-50. A loan of Rs 1 lakh cannot be issued if processing cost is Rs 1,000 and cash transaction cost is Rs 1,000. But with digitisation and processing cost dropping to Rs 50, you can talk about Rs 15,000-20,000 loans. This makes the potential for small food processing units much higher.

The last point is that the registration of small enterprises is actually starting to become much easier and cost of avoidance is much higher, so there is an incentive to actually become formal. The moment you become formal, you get better regulation, you get better finance, and most states are easing labour regulations. This is a change which will have an impact over 5-10 years. In the combination of all this, I think food processing will benefit. You can create jobs in the villages in this environment.

FPJ: Now we begin to realise there are many things not heard about, which promise a lot. First question to Mr. Rath. In milk, we have seen a classic situation where it is possible to double farmer incomes. Maharashtra co-operatives used to pay about Rs 18 a litre, now in Vidarbha the offer is between Rs 26 and Rs 30. So effectively it is almost doubling the income in farmers. Do you think income through the milk sector is the fastest way to grow farmer incomes?

Rath: Dairy is one of the important tools, which will contribute in this process of doubling farmer’s income. Income from dairy contributes about 25 per cent of the total income of the rural households. With greater market access being provided, and also the increase in the productivity of animals which is very important, there is scope to increase profitability of the farmer level.

FPJ: Right. Anantha, you have a situation where milk has been doing very well but there are other sectors that also could do wonders. I believe you are doing some amazing things in processing coconut and creating new products, can you talk it?

Supported by

Padmanabhan: That is something which we have done in Sri Lanka, Philippines and Thailand. Coconut is a very interesting product. There was a time we were told that coconut oil is not good for health, but now all of a sudden the world has realised that coconut oil is very good for health. From coconut as a product, we have coconut water, coconut milk and coconut oil which comes out of it. And of course you have the waste products coming out of the shell and the husk. We are focusing more on virgin coconut oil. You heat the coconut milk in a pan and then the oil floats on the top. That is a very high quality oil. But that process needs heat and that oil is oxidised and that oil has got lesser shelf life. However, today the same quality of oil could be made from coconut milk where the cream is separated, and converted into oil. The whole process happens under very low temperatures and under hygienic conditions. The price of this oil goes up almost fivefold by the time it reaches the market. It becomes a high-value product. We have our first project in India happening in Coimbatore. There— what I was mentioning about the lesson to be learned from what the NDDB did with the dairy industry— the collection centre is very close to the farmer and from there the processing plants are not so far away.

Another interesting thing bringing in international technology, is in production of Amla (gooseberry) juice with a well-known local-oriented brand. It is a very modern plant which can produce high-quality juice, so that is technology and adaptation. Again, I should mention NDDB, we have worked with them all these years, right from Operation Flood and we continue to learn with them.

FPJ: Neelkanth, a small question for you. Dilip Rath talked about private investment creating the multiplier effect on the seed capital that the government has said it will provide. What is the investment sentimental like? Will that money be forthcoming very quickly? Is the sector a priority sector for investors also?

Mishra: I mostly deal with investors in public markets, where today market capitalisation of companies who produce or sell processed food is maybe Rs 2,80,000 crore or so, which is mostly large multinationals and then some domestic names. However, the level of investment we are discussing will by definition be away from the public market. Setting up one large factory is not enough to move the needle, I think it will need tens of thousands of small units to crop up.

On the procurement side, at least in fruits and vegetables, the procurement has been eased mainly through the repealing of APMC powers. However, just repealing is not enough, destroying a monopoly is good but you have to create a parallel market. So that takes time, a lot of investment and network creation. This annulment has allowed private companies to directly approach farmers and procure items, and price transmission is actually much better for the farmers. With all this, there is a scope for start-ups and venture capital coming into food processing. I was told by the Canadian consulate that McCain has a very large potato processing plant in Gujarat, a single location which supplies potatoes for all of McDonald’s and Burger King, very high-end quality material. So there is investment now starting to happen given that evaluation is available, electricity is available, farmers are more informed and APMC has been repealed. It’s very hard to quantify whether it will be Rs 10,000 crore or 20,000 crore, but the ecosystem is now ready and it’s a matter of time.

Digital partner

FPJ: Okay. There are two other things that started, but sputtered, one is commodity markets, where the farmer can get a price discovery mechanism market. The Governments turned it on and off again and again, it has been a disaster story in a way. And the second problem is the beautiful regulation called a Warehousing Development Act, whereby you could have dematerialised receipts for grains and which in turn could have facilitated the growth of processing industries. Where do you think we will go on these two fronts or any other front that would facilitate this industry?

Mishra: Both these issues are actually relevant for only a third of India’s agri-output, basically for non-perishables. I think the potential for increasing farmer realisations is much higher on the perishable site. There was another initiative like the Electronic National Agriculture Market (ENAM), which again does not seem to be working well at national level, because again creating a market is hard work. Private markets do come up, like in Bihar, where there is no infra but people have informally decided to gather and there are aggregators who are paid by financiers. The problem with ENAM is quality control, I may buy litchis from Muzaffarpur sitting here and what is the guarantee of quality?

Perhaps on the commodity side what we have been thinking is that creation of market is enough without creation of enabling infrastructure. Another issue is that our institutions are not philosophically and intellectually committed to the concept— the mechanism. Whatever set up you create and people start learning the process, developing skills, and at the first sign of a price spike it gets shut down, instead of being managed with margins and other mechanisms. There has to be a philosophical or intellectual commitment coming within the government, which so far has been lacking.

COMMENTS