http://www.freepressjournal.in/analysis/can-gold-be-made-less-attractive-for-smugglers-en-bhaskar/1101981

Can the government make gold a cleaner, more profitable, business in India?

— By | Jul 13, 2017 07:16 am

Listen carefully to the words that are constantly being uttered by government spokesmen. They talk about driving black-marketeers to the ground. They speak of the need to reduce India’s penchant for gold. And they promise to unearth black money. All pious sentiments, true.

But now look at the facts.

First, according to the government’s own admission before the Lok Sabha (reply to unstarred question No. 266 of Feb 3. 2017), “the Government does not maintain any data regarding holding of gold . . . . . However, as per estimates over 20,000 tonnes of gold are held by households, trusts and various institutions in India.” Even assuming a price of Rs.27,000 for 10 grammes, the value of gold holdings is a mind-boggling Rs.54 lakh crore. It is sad that after 70 years since independence, India still does now know the profile of people holding gold.

First, according to the government’s own admission before the Lok Sabha (reply to unstarred question No. 266 of Feb 3. 2017), “the Government does not maintain any data regarding holding of gold . . . . . However, as per estimates over 20,000 tonnes of gold are held by households, trusts and various institutions in India.” Even assuming a price of Rs.27,000 for 10 grammes, the value of gold holdings is a mind-boggling Rs.54 lakh crore. It is sad that after 70 years since independence, India still does now know the profile of people holding gold.

Second, the government admitted (through its reply to the Lok Sabha unstarred question No.387 of Friday, 3 February 2017) that post-demonetisation, the income tax department conducted more than 1,100 searches, seizures and surveys and issued more than 5,100 notices, during the period 9th November 2016 to 10th January 2017. It wanted to verify suspicious high value cash deposits in old high denominations. “These actions led to seizure of valuables of more than Rs. 610 crore which includes cash of Rs. 513 crore. Rest of the seized valuables is mainly in the form of gold, jewellary and silver.” This means that unaccounted gold & jewellery seized by the authorities was just a paltry Rs.97 crore! That too over a three-year period.

Third, don’t expect the customs department to unearth smuggled gold that easily. As the government itself admitted through its reply to the Lok Sabha unstarred question No.384 of 3 February 2017, the total seizure of gold (and gold ornaments) accounted for just 7.131 tonnes during the latest three year period (2013-14 to 2015-16). This is the figure after the high decibel coverage of gold seized from airports and elsewhere.

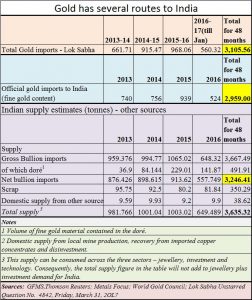

Fourth, look at the table alongside. Compare the 7.131 tonnes seized with the discrepancies in the amount of gold that was imported into India. The Indian government believes that 2,959 tonnes of gold were imported into India over a four year period. . The statement before the Lok Sabha which gave the figure of 3,105,6 tonnes possibly included gold dore and jewellery as well. Now compare this with the figure collated by global research companies. They put the figure at 3,246 tonnes. This figure excludes gold dore imports, and does not include recycled gold. There is a clear difference of 250 tonnes which has got smuggled into India. And the customs seized just 7 tonnes! The value of 250 tonnes at a price of Rs.17,000 per 10 grammes is Rs.67,500 crore. The seizures of 7.131 tonnes amount to Rs.1,925 crore.

In fact, the quantum of gold smuggled into India could be a lot higher. Ask local traders and they expect the figures of gold smuggled in to be at least 100 tonnes a year. Even if one discounts this larger figure, the divergence among three sets of figures — the income tax seizures of Rs.97 crore, the customs seizures of 7.1 tonnes (Rs.1,925 crore) and the ‘smuggled in’ figure of 250 tonnes (Rs.67,500 crore) – is uncomfortably and embarrassingly huge.

Is it that India does not know how to prevent smuggling? Not really. India’s customs and income tax officials try their best. But the flaw lies in the import duty structure imposed by the finance ministry under Chidambaram, which continues to this date.

This brings us to the fifth and most important point. Smuggling of gold becomes profitable when import duty rates are over 5%. This is because the cost of smuggling (conversion of domestic black money in foreign exchange, transportation, delivery) is around the 5% mark. A 10% import duty is, therefore, profitable, and actually encourages smuggling (http://www.asiaconverge.com/2015/12/gold-smuggling-makes-our-rupee-poorer/).

What is more worrisome is that when smuggling of gold becomes attractive, it subsidises the creation of a pipeline that smugglers can use for importing anything else as well. The pipeline may begin with gold. But it is soon used for smuggling in drugs and even arms. That is why it is imperative that the pipeline is busted at the earliest. At 10% import duty, gold smuggling becomes extremely lucrative – because it is high value low volume movement of consignments through a large and porous maritime coast (and through the jungles along India’s borders).

Now with the imposition of GST of an additional 3%, the difference between international and domestic prices is a cool 13% making smuggling in of gold even more attractive.

If the government wants to reduce smuggling and clean up the gold trade, it needs to address the issue of duties first. It must seek to bring the difference between domestic and international prices to not more than 5%.

Will the government work towards making gold less attractive for smugglers?

COMMENTS