The reasons which have made Israel a super-startup nation

Rn bhaskar

Fifteen years ago, Israel looked a bit vulnerable – economically, not militarily.

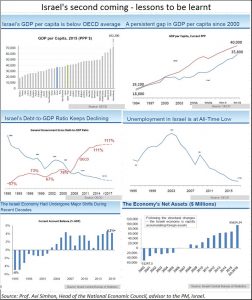

True, it sought to align itself with the western world – especially the US and the EU. But Israel’s GDP rankings were not among the best.

Yes, there were worse  performers than Israel – notably Spain, Portugal and Greece. However, languishing at levels 20% lower than its OECD peers was discomforting.

performers than Israel – notably Spain, Portugal and Greece. However, languishing at levels 20% lower than its OECD peers was discomforting.

Its GINI index was high, suggesting enormous income disparities. Was the much famed Israeli engine slowing down? True its skills in improving agricultural yields and water management were legendary (http://www.freepressjournal.in/business/india-has-become-key-focus-area-for-netafims-ceo-ran-maidan/1022717). But Israel needed to go beyond this.

The turnaround began from around 2005. Its debt to GDP ratio began falling. While this number for OECD countries climbed from 57% to 117%, Israel’s ratio halved to from 130% to 62% (see chart alongside – the full version of the charts can be downloaded from http://www.asiaconverge.com/wp-content/uploads/2017/02/2017-02-09_Simhon-Israeli-Economy-Macro-Presentation-Feb-2017.pdf). It seemed as if Israel was on the march once again. Other numbers corroborated this. Government expenditure as a percentage of GDP began falling. From around 80% of total expenditure during the 1990s, it had fallen to around 55% in 2002. Currently it stands at almost 40%. More investment was now being met out of private funds.

The unemployment number also came down to around 4%.

Exports by the hi-tech sector began climbing sharply from just $40 billion in 2005 to $80 billion by 2015. The current account deficit number had also begun to look a lot healthier.

How did this happen?

According to Prof. Avi Simhon, Head of the National Economic Council, advisor to the PM, Israel, the country realised that it would have to start lifting protection to its local industries slowly. Its policymakers also realised that Israel had no single global brand. “We did not have a Nokia, or an Apple,” explains Simhon. “We had to expand the scope of all its small and medium sized companies. “

The first step was to encourage industry to step up its research and development capabilities. That worked. Today, almost 4.2% of GDP is spent on R&D in the civilian space – one of the highest in the world. As against OECD’s average of 8 researchers for every 1,000 people, Israel boasts of 14.

But industry wanted more engineers. True Israel did produce many maths and science graduates from its splendid universities. But industry wanted engineers, not just theory churners.

So Israel’s planners went to the universities. They explained their problem to the academicians. But instead of just allocating money, they provided funds for a 40% increase in engineers, without reducing funds for other streams. Quality control at the intake level and focus on output standards were reinforced.

Then it began liberalising its immigration rules. It began permitting import of skilled workers provided they could earn at least $5,000 a month.

It then began working on ways to create the right ‘chemistry’ at its universities. It began looking for the brightest and best of students from all over the world. Since teaching in Hebrew could be a challenge, it even began teaching courses – as in Technion – in English. That increased the ratio of foreign student in Israeli educational institutions. Simhon is happy to point out that currently most of the foreign students are from India. As a result, everyone benefits: the university gets excellent talent, the industry taps this resource, and the country watches the results of this ‘chemistry’ translate into hi-tech exports.

“Of course”, adds Simhon, “we still have some problems. Most girls do not want to become engineers. They prefer to be teachers, or study humanities. They qualify for engineering courses, but do not take it up. We are looking for ways to address this problem.”

Then there is the problem of income inequality. “We like to begin all skilled workers at higher salary levels. But there are sections where that alone is not enough,” explains Simhon. He points to the ultra orthodox communities which have an average of 7.5 children per family. Then you have the Arab population which has not risen in income levels. In fact, there is a huge disparity between income levels of Christian Arabs and Muslim Arabs. Many of these communities do not even encourage their women to be educated and begin working. This is not true of the ultra orthodox, however, where the men pursue religious studies, while the women go out and work.

But the biggest contributor has been the improvement of ‘chemistry’ at the academic levels, and the focus on quality engineering. That, and the fabled Jewish entrepreneurship, have caused the levels of wealth generation to spurt.

India could learn a lot from such measures. But will it?

Note: as mentioned above, A fuller version of the chart can be found at 2017-02-09_Simhon-Israeli-Economy-Macro Presentation Feb 2017

COMMENTS