http://www.freepressjournal.in/analysis/king-coals-rise-decline-and-eventual-fall-r-n-bhaskar/912190

King Coal is rapidly losing market relevance

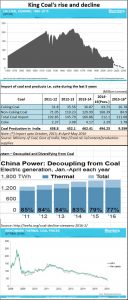

Few thought this would ever happen. In fact, if you plot a chart of coal demand in the UK for the period 1860 till 2020 (http://about.bnef.com/presentations/liebreich-state-of-the-industry-keynote-bnef-summit-2016/ also see chart), the image tells you more than words can.

Coal, the world over is seeing dark days like seldom before. It has been hit by three factors.

Coal, the world over is seeing dark days like seldom before. It has been hit by three factors.

First the expected down-swing that takes place with most cyclical growth commodities.

Second, it has been ravaged by falling gas, then oil, prices. The falling tariffs of, and increasing investments in, solar power are likely to ensure that the demand for coal does not grow strong once again. Most incremental power generation capacities are in renewables, or even nuclear power.

Third, global determination to beat global warming by phasing out coal could be the last straw to break its back.

But coal is far from dead. It remains, as a recent EIA paper points out (http://www.eia.gov/forecasts/ieo/coal.cfm) the second-largest energy source worldwide—behind petroleum and other liquids. It is likely to retain this position till 2030. From 2030 through 2040, it will be the third most important energy source, behind both liquid fuels and natural gas.

According to the EIA, world coal consumption is expected to increase at an average rate of 0.6%/year, from 2012 to 2040, from 153 quadrillion Btu in 2012 to 169 quadrillion Btu in 2020 and to 180 quadrillion Btu in 2040. EIA admits that this does not include the recently finalised Clean Power Plan (CPP) regulations in the US, which would reduce world coal consumption to 165 quadrillion Btu in 2020 and to 176 quadrillion Btu in 2040 (about 2.5% in both years). Coal may thus still see more dismal days ahead.

There are other worrying signs for coal. China which accounts for almost 50% of world coal consumption has sharply cut back its use. Its investments in solar, other renewables and nuclear appear to be more promising. The other two consumers – US and India (together the three countries account for 70% ofr global use) – have also begun looking to solar power.

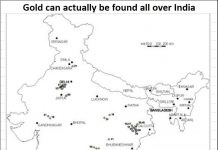

In India, increased domestic coal production will mean shrinking coal imports (see chart alongside). Already, NTPC, the largest consumer of coal in India, has plans to activate its captive mines which are expected to meet over 40% of its coal requirement within the next five years. Coal imports which used to bail NTPC out in the past, have already trickled to a fraction of 1%.

That could explain why many Indian entrepreneurs have jettisoned their plans to develop coal mines overseas. It will, therefore, not be surprising if the Adani group — which unveiled some of its most ambitious plans to mine coal in Australia, with supporting rail and port infrastructure which were also to be financed by this group – begins to either roll back its plans, or scuttle them lock, stock and barrel.

The biggest body blows are likely to come from non-conventional energy. At present the big bets are on solar. With latest tariffs at under 3 cents a kWh, and with falling battery prices (they could be just 25% of current costs in a couple of years), solar is likely to edge out investments in thermal power generation in a big way.

EIA also points out how electricity generation accounted for 40% of world coal consumption in 2012. But with renewable energy, natural gas and nuclear power increasing their presence in this sector, it expects the share of coal to fall to 29% by 2040. The industrial sector accounted for 36% of total coal use in 2012. But its share could increase to 38% by 2040. Coal use in other sectors (residential and commercial), which made up 4% of total world coal consumption in 2012, is likely to account for 3% of the 2040 total.

There could be two factors that could help coal shore up its share in the energy basket.

The first is the continued falling prices – see chart. If coal prices fall further, it is just possible that some industries and power plants may prefer to continue to use coal.

The second is when countries like India and China decide to continue their domestic coal mining operations (a) because they are cheaper than imported coal, and (b) because they save on foreign exchange outgo. They also create employment, a factor neither India nor China will dare to ignore.

In conclusion: Coal is there to stay. But fresh investments may consider using other fuel alternatives. They hey-days of King Coal appear to be over.

COMMENTS