https://www.freepressjournal.in/analysis/fpj-edit-gloom-worries-economy-watchers

Signs of gloom worry economy watchers in India

RN Bhaskar – 28 November 2019

The government refuses to admit this. But all the reports compiled by experts appear to suggest that the economic gloom could get darker in the coming months. Last week, economist and columnist Swaminathan S. Anklesaria Aiyar suggested that the GDP growth rate could plummet even lower to around 4%. It has steadily fallen during the last four quarters from 7%, 6.8%, 5.6% and 5%.

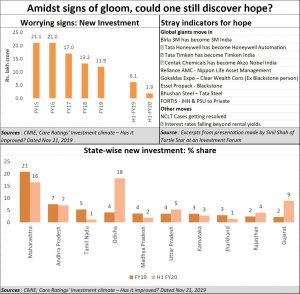

Then you have the recent report of CARE Ratings (21 November, 2019) on “Investment climate – Has it improved?”. It points out how “The investment rate measured as the gross fixed capital formation (GFCF) as a percentage of GDP has declined consistently over the years and remained range bound between 28%-29% of GDP in the past 4 years. This has been a detrimental factor for the overall economic growth of the country.” It goes on to add that “new investments projects in FY19 were seen to be the lowest in the past 5 years while for the first half of FY20, it fell to a 15 year low.” The chart reproduced alongside shows how sharp the fall has been.

Then you have the recent report of CARE Ratings (21 November, 2019) on “Investment climate – Has it improved?”. It points out how “The investment rate measured as the gross fixed capital formation (GFCF) as a percentage of GDP has declined consistently over the years and remained range bound between 28%-29% of GDP in the past 4 years. This has been a detrimental factor for the overall economic growth of the country.” It goes on to add that “new investments projects in FY19 were seen to be the lowest in the past 5 years while for the first half of FY20, it fell to a 15 year low.” The chart reproduced alongside shows how sharp the fall has been.

What is worse is that most states have witnessed lower investments compared to the previous year. The only exceptions appear to be Odisha (which has – finally – shown a surge in investments), Uttar Pradesh and Gujarat. Maharashtra which used to be the national leader also saw declining investments.

Yes, there are some silver linings in the clouds. In 2015 the government accounted for a major share in the investment pie at 56% — leaving the private sector to contribute to have a 44% share. But last year, even as the size of the pie got reduced, the share of the government fell to 36%, with the private sector accounting for 64%. Hopefully, the private sector will use capital more carefully.

Linked to this is another development. Many Indian companies gradually moved from the hands of Indian entrepreneurs to those of global giants (see chart). Thus, Birla 3M has become 3M India; Tata Honeywell has become Honeywell Automation; Centak Chemicals has become Akzo Nobel India; Reliance AMC has become Nippon Life Asset Management and Bhushan Steel has become Tata Steel.

Some of the erstwhile promoters of such projects were beneficiaries of crony capitalism which in turn played havoc with bank finances and loans. Hopefully, with more responsible investors moving in, these assets will get utilised in a better manner.

That should be good news, but for one problem. The government’s willingness to play favourites appears to be undiminished. Just witness the way it has played around with the telecom sector (http://www.asiaconverge.com/2019/10/is-india-telecom-sector-being-skewered/). There is also the way the PMC Bank promoters were treated with kids’ gloves till the scam became too big to push under the carpet. Also watch the way it almost sold away the interests of India’s dairy sector during the RCEP talks (http://www.asiaconverge.com/2019/08/indian-bureaucrats-forgot-to-protect-indian-milk-from-imports/). The last has mercifully been shelved. But the other two instances remain as a warning that India’s economic interests could get sabotaged irreparably.

Even politically, watch the way the Coastal Economic Zone concept — which promised to usher in more jobs and create huge wealth for India (http://www.asiaconverge.com/2018/07/troubled-waters-owns-right-way-indias-coasts/) — has been put on the back burner. Just last year, it promised to become the haven of investments in this country. Finally, talk to global investors, and they tell you that till India can ensure speedy dispute resolution and investment protection, big investments are unlikely to flow into the country (http://www.asiaconverge.com/2019/05/speedy-dispute-resolution-is-crucial-for-economic-growth/). It may be recalled that India cancelled as many as 56 Bilateral Investment Treaties (BITs) in 2014. That discouraged investors in Indian projects from seeking dispute resolution in international courts of arbitration with the seat located outside India (to benefit from the Supreme Court ruling that awards given by seats outside India could not be reopened by Indian courts). Now there is no investment protection agreement, nor any guarantee of speedy resolution. That is a toxic mixture which frightens investors.

That could also explain why, as the CARE Ratings report points out, “In H1 FY20, the new investments by the private sector have contracted by 77% compared with the 23% growth in H1 FY19.”

But there is hope still. Do remember that India still has a 4-5% GDP growth rate. But funding challenges will remain. The banks are chary of lending to promoters who could default, and the NBFCs are still too small to take over the job. Foreign investments are sorely needed, and Indian should move quickly on this front. Can it do so?

You can contact the author at rnb@asiaconverge.com

COMMENTS