https://www.moneycontrol.com/news/business/budget-2019-from-power-to-powerlessness-risks-are-real-4081751.html

Union Budget 2019: How to stop the country from going from power to powerlessness

RN Bhaskar — June 10, 2019

The countdown has begun. Most marketmen have begun looking to the next budget proposals – the first to be announced by the Modi government which was just swept into power with a massive mandate.

The countdown has begun. Most marketmen have begun looking to the next budget proposals – the first to be announced by the Modi government which was just swept into power with a massive mandate.

The budget has to contend with major financial difficulties. The rupee is slipping – as expected – after elections. A slipping Index of Industrial Production (IIP) is one major headache. If more jobs ar to be created, this index needs to go up (https://www.moneycontrol.com/news/business/economy/even-the-iip-suggests-that-india-has-a-painful-six-months-ahead-unless-3995381.html).

An economic slowdown is much in evidence (https://www.moneycontrol.com/news/business/economy/opinion-brace-yourself-for-an-economic-slowdown-3401971.html). FDI (foreign direct investments) have begun dipping as expected (https://www.moneycontrol.com/news/business/opinion-efficient-dispute-redressal-system-a-must-to-boost-fdi-3943071.html). The bank NPA problem continues to fester (http://www.asiaconverge.com/2019/01/lessons-learnt-npa-recovery/).

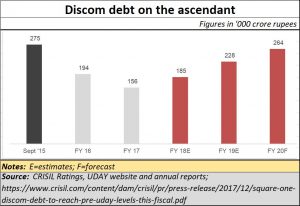

The total quantum of losses banks, mutual funds and insurance companies will be exposed to thanks to the collapse in the values of Essel Group Companies and IL&FS remains unclear, because the game has still to play out, and also because insurance companies have not yet disclosed the erosion in their portfolios (http://www.asiaconverge.com/2019/04/make-mandatory-investment-disclosure-by-insurance-companies/). Then there are the unpaid bills of the previous government which could be over Rs.12.4 lakh crore (https://www.moneycontrol.com/news/india/new-government-will-inherit-unpaid-infrastructure-bill-of-rs-12-4-lakh-crore-3937001.html). Add to this the populist schemes that must be paid for (http://www.asiaconverge.com/2019/04/doles-freebies-will-result-in-corruption/). And finally, the growing losses of power distribution companies or discoms (see chart).

Will the budget come forth with radical ideas, and out-of-the box solutions, or will it allow the old system of subsidies and money distribution to continue? To be fair, there is nothing wrong with subsidies or money distribution. But this makes sense only if there is a focus on wealth generation too. Without generation of wealth, the largesse will only end in distribution of poverty, not wealth. And nowhere will this be more visible than in the power sector.

Basics:

Consider the bare facts. Unalloyed. As a CRISIL report of May 6, 2019 showed (https://www.crisil.com/en/home/newsroom/press-releases/2019/05/square-one-discom-debt-to-reach-pre-uday-levels-this-fiscal.html) “aggregate external debt of state-owned electricity distribution companies (discoms) is set to increase to pre-Ujwal Discom Assurance Yojana (UDAY) levels of Rs 2.6 lakh crore by the end of this fiscal. With most states having limited fiscal headroom, continuous financial support to their discoms may be difficult.” The CRISIL analysis was based on a study of discoms of 15 states which account for 85% of the aggregate losses.

The budget has to address this problem. If this problem remains unaddressed, expect power production to decline, instead of increasing as some economists have indicated in their surveys recently. Power generation is slated to grow by 5-6% during FY20 they say. This, they believe, will be on account of the newly connected households to the power grid. But if states don’t have the money they will stop paying large power generators, which in turn will stop supplying them additional power.

Look at the CEA annual report for 2018 (http://www.cea.nic.in/reports/annual/annualreports/annual_report-2018.pdf), It too points out how outstanding dues of power utilities payable to central public sector undertakings (CPSUs) as of 31 March 2018 had touched Rs.13,785.97 crore. Add to this the money owed to coal producers, and to distribution companies for the subsidised power given to rural areas, and the losses that state grids have noted up. The picture isn’t pretty.

Look at the CEA annual report for 2018 (http://www.cea.nic.in/reports/annual/annualreports/annual_report-2018.pdf), It too points out how outstanding dues of power utilities payable to central public sector undertakings (CPSUs) as of 31 March 2018 had touched Rs.13,785.97 crore. Add to this the money owed to coal producers, and to distribution companies for the subsidised power given to rural areas, and the losses that state grids have noted up. The picture isn’t pretty.

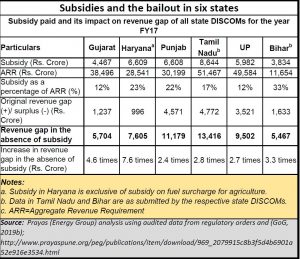

A good indicator of the role that subsidies play has been brought out quite sharply by Prayas (see table).

First the states compel grids to provide subsidised power – and at times ask them to even conceal losses – to key constituencies. Then they act benevolent and grant a subsidy to the power discoms. But had the subsidies not been given the plight of the discoms would have been greater by two to eight times!

Ideally, the budget should penalise states if they do not reimburse in full the losses discoms face. Any outstandings of discoms to third parties for coal or power purchases must be settled within a fortnight, or else they should be debited to the state’s account where revenues like GST pour in. This is what several committees on power losses have recommended in the past. But nothing has been done partly because politicians don’t like it, and also because — unless both houses of the Parliament permit it — a direct debit to state finances is not possible. Yet, there is no denying that such disincentives need to be provided for, or state grids and politicians will not mend their ways. And most states splurge on power costs without even batting an eyelid.

The forthcoming budget needs to spell this out. It is urgently needed.

Yet, even if the budget does not do this, there are other market forces that will bring errant discoms and their state governments to heel. Recent developments on the rooftop solar front threaten to make state-owned power grids and discoms less relevant to common people.

But more on that later.

COMMENTS