http://www.freepressjournal.in/analysis/gold-import-duties-need-to-be-streamlined-rn-bhaskar/1372617

Gold import duties begin to attract attention

— By | Oct 11, 2018

Last fortnight, the government of India released a list of 19 items where import duties had been raised.

Last fortnight, the government of India released a list of 19 items where import duties had been raised.

What was interesting was that despite a clamour from the trade that import duties on gold should be increased, this was not done. Instead, the government incr5eased duties only on three items that were related to gold

- Cut and polished Colored gemstone (HSN 71) where the duty was raised from 5% to 7.5%’

- Articles of jewellery and parts thereof, of precious metal or of metal clad with precious metal (HSN 7113), where the duty was increased from 15% to 20%; and

- Articles of Goldsmith or silversmith wares and parts thereof of precious metal or of metal clad with precious metal (HSN 7114) where duties were raised from 15% to 20%

This obviously led people to asking why gold had been spared, and why other items linked to gold had been slapped with an increase in import duty.

Let’s take the second query first. Watch the second table in the chart alongside. Watch how the import of gold jewellery had soared from around $500 million to around $1,800 million. Clearly, something had begun to make import of gold jewellery very attractive.

Let’s take the second query first. Watch the second table in the chart alongside. Watch how the import of gold jewellery had soared from around $500 million to around $1,800 million. Clearly, something had begun to make import of gold jewellery very attractive.

Ask gold traders. They will tell you – under condition of anonymity — that this happened because of two reasons. First, the special trade treaties that India enjoys with countries like Thailand made import of gold jewellery very attractive – such imports are exempt from import duties. Second, GST made the cost of manufacturing jewellery a bit more expensive since it is applicable to contract labour and to the finished produce. Most contract workers in the jewellery sector are paid in cash. Thus no GST set-offs are possible. It thus becomes easier and cheaper to import finished jewellery from nearby countries like Thailand.

As Care Ratings was to point out in its report of 27 September 2018, “In the gems and jewellery sector, as a part of the CAD [current account deficit] reduction measures, the government has not imposed any additional duty on gold. . . . . . Import of jewellery and finished products had increased significantly in FY18, but the momentum has not kept pace in FY19 till date. Further, with a clear demarcation of duty imposition on finished jewellery products, it is apparent that the government is promoting value added domestic manufacturing. A few unique imported jewellery and related items may witness a marginal price increase bur demand reduction is not anticipated as this small segment is not price-sensitive.”

Naturally, enough, the government moved in quickly by slapping such imports with higher customs duties. Moves are also afoot to impose countervailing duties on imports from such countries, so that the import duty exemption can be neutralised.

But why was gold itself spared? There could be two possible reasons for this.

For this, one has to look at the current import duty of gold. It rests at 10% today, plus cesses and GST. As market watchers will be happy to explain, any import duty rate of over 5% for a low-volume high-value item like gold only makes smuggling quite profitable. The present import duty and GST have made the smuggling in of gold quite attractive (http://www.asiaconverge.com/2017/07/duties-taxes-corruption-government-abets-smuggling-gold/). That, say sources, allows around 40-80 tonnes of gold to get smuggled in each year. That accounts for around 15% of domestic demand.

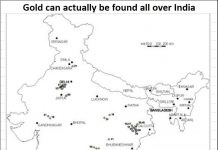

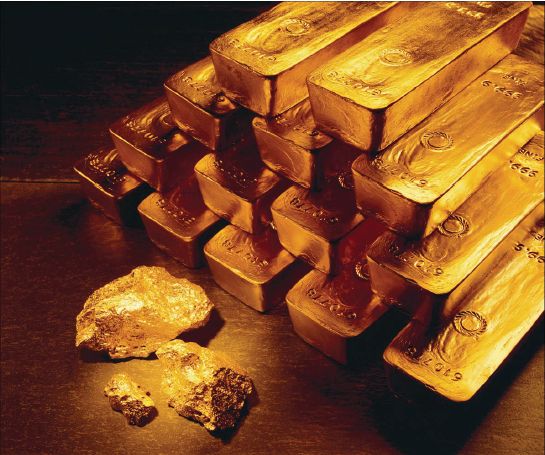

India’s demand for gold is estimated to be around 800 tonnes a year (see table alongside). The government itself admits (before the Lok Sabha on 31 March 2017 (unstarred question no. 4842) that “[even though] there are no firm statistics on estimated demand and availability of gold in the country . . . as per rough estimates gold demand in the country is 800-900 tonnes per annum.”

Gold imports in 2018 are believed to have fallen (though final figures have yet to be compiled). Hence the need for increasing duties was not felt necessary.

Moreover, there were genuine fears that a higher import duty would make smuggling in of gold even more attractive. Hence the move to slap additional duties on gold imports was shelved.

That was (refreshing) pragmatic thinking on the part of India’s law makers. Now they need to move into phase two. Can it introduce policies that could use India’s gold to ease the country’s current account deficit (CAD) problems.

We shall deal with that shortly.

COMMENTS