http://www.freepressjournal.in/analysis/gold-we-trust-but-market-uncertain/1156098

Gold, Germany and India

— By | Oct 19, 2017 08:01 am

Gold markets continue to be poised on the tip of uncertainty. There is all round confusion. There is no faith in oil prices – they could fall to as low as $25. There is little faith in countries either. The protectionist policies being pursued by the US could render it less competitive than before, and the worsening of ties between the US and almost every other country in the world does not inspire confidence in the US$ either. Much of Europe remains in the ZIRP or NIRP regions (ZIRP stands for zero-interest rates payments while NIRP for negative interest payments). That, in turn has made people worried about keeping money in banks too. The countries that offer higher rates of interest are also high risk territories. Only investors with nerves of steel would be willing to foray into high-risk-high-return opportunities.

Not surprisingly, gold becomes more attractive. Watch Germany. It is a country known for its sobriety and financial prudence. German investors too turned to gold to protect their wealth. And as the World Gold Council states, “In response, new product providers entered the market making it easier for people to invest. Last year, more than €6bn was ploughed into gold investment products in Germany and, encouragingly, there is room for further growth: consumer research indicates there is latent retail demand which the industry can tap into (https://www.gold.org/research/market-update/market-update-german-investment-market)

Not surprisingly, gold becomes more attractive. Watch Germany. It is a country known for its sobriety and financial prudence. German investors too turned to gold to protect their wealth. And as the World Gold Council states, “In response, new product providers entered the market making it easier for people to invest. Last year, more than €6bn was ploughed into gold investment products in Germany and, encouragingly, there is room for further growth: consumer research indicates there is latent retail demand which the industry can tap into (https://www.gold.org/research/market-update/market-update-german-investment-market)

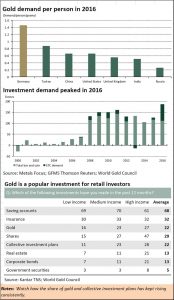

Watch the charts alongside. Watch how the per capita holding of gold in Germany has soared. India may have the largest private holding of gold in the world – estimated at 25,000 tonnes. But when taken on a per capita basis, India shrinks in comparison.

But as times become turbulent, expect private consumption fo gold to shoot up in India as well (http://www.asiaconverge.com/2017/07/india-loves-gold1/). Some may be through ETFs and other financial products the markets introduce. But much of rural purchase of gold may be in a physical form. It is quite likely that India too will see a spurt in gold demand in the coming year.

At least 100 tonnes of gold are smuggled into India each year to meet this demand. Unfortunately, the government, ostrich-like, prefers to believe that the problem does not exist at all. All through 2000 and 2007, gold imports have been range bound at around 400-500 tonnes a year. But it began climbing with the onset of the financial meltdown in 2008 — from 647 tonnes in 2008 to 939 tonnes in 2015. It slipped to 524 tonnes in 2016, but that was on account of terrible monsoons during the previous two years. Now, with good rains expect gold imports to rise.

Gold smuggling means an outgo of around Rs.25,000 crore a year. Since smuggled gold is paid for in black money or is bartered against silver or drugs, it also poses a major security issue. What about seizure by customs? That is laughable. Despite the noise generated, actual seizures have amounted to just 1-3 tonnes a year for the past three years (http://www.asiaconverge.com/2017/07/duties-taxes-corruption-government-abets-smuggling-gold/).

But is smuggling in of gold very profitable? The answer is yes. Since gold is a low-volume-high-value item, the cost of transportation is almost nil. Gold traders will tell you that the entire cost of smuggling gold into India is under 5%. This includes risk premiums too, because one has to take into account some losses through accidents or seizures.

The government knows this. In spite of this it continues to levy a 10% import duty on the metal. The government, thus, actually, encourages the smuggling in of gold. The imposition of an addition 3.5% GST on gold has made the smuggling business even more profitable. True, the government has removed payment of IGST for gold import even while this column was being written, but the 10% import duty still leave gold smuggling extremely attractive.

Since GST tends to look at all income streams – right from trucking to fuel consumption to jewellery purchases, the gold trade has begun working on creating a channel where end-to-end transactions are off the book – fuel for the boats, for the trucks, lease rentals for the trucks and safe houses, and the eventual sale of the gold as ornaments or coins to common people. All these are kept off the book. The trade has been working on this for the past 3-4 years. Post GST, a 13.5% margin between locally available gold and international prices has made gold smuggling extremely attractive. (http://www.asiaconverge.com/2017/07/duties-taxes-corruption-government-abets-smuggling-gold/).

.Once the channel is ready, this conduit can be used to smuggle in drugs or even arms. Willy-nilly, the government is actually creating a big security problem for itself.

That is why, it is imperative that the government modifies the gold import structure immediately. This author has been recommending a structure where all gold is imported through designated banks at 1% import duty. Gold purchased through non-designated banks will continue to invite a 10% import duty.

Let the banks give the gold to the trade at a markup of 2%. That gives the banks some profit, and gives the wholesale trade the ability to sell the gold to retail traders at a markup of 1-2% (http://www.asiaconverge.com/2017/07/can-the-govt-clean-up-the-gold-trade/). Cumulatively, the total cost will be under 5% making smuggling in of gold less profitable. It will make India more secure as well.

Unfortunately, the government isn’t listening. So expect gold smuggling to increase. Expect security loopholes to get wider. And expect a lack of confidence in the economy to push up gold purchases faster than before.

COMMENTS