http://www.freepressjournal.in/is-modis-economic-vision-getting-hazy-r-n-bhaskar/814854

Is Modi’s economic vision getting hazy?

Mar 31, 2016 01:08 am

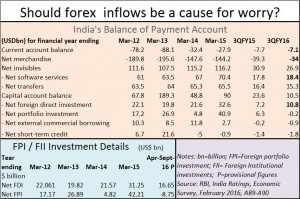

At first blush, India’s economic engine under Prime Minister Modi appears to be faltering. True current account deficit (CAD) in Q3 2016 is lower than in Q3 2015. Net merchandise imports too dipped during this period. But, overall, forex inflows on the capital account declined.

Even foreign direct investment (FDI) inflows have weakened – from $32.25 bn to 16.65 bn – during this period. Ditto for foreign portfolio investments (FPI) – see table. News about JP Morgan exiting India made many uneasy. Last year it was Goldman Sachs SA and Deutsche AMC which packed up bags and left India. That was on the heels of PineBridge Investments Asset Management of Fidelity shutting shop here. So, is India becoming a less attractive place for investment?

That may not be true for several reasons.

First, the exits this year appear to be linked to the fall in oil prices, which have made the oil producing countries suck their sovereign wealth funds (SWFs) money out of hedge funds. Since the poorest performer was the emerging markets (EM) segment, funds were pulled out from here. Unfortunately, India is clubbed with the ERM. Thus, despite a robust GDP growth rate, it suffered because the EM lost out. It is only now that India specific funds are being talked about. Till that happens, investment inflows into India will remain weak.

Second, the fall in oil prices have even begun to affect remittances, as jobs in oil producing countries are lost. That could explain the dip in invisibles (net transfers).

Third, inflow of hot money through the Participatory Notes route have been almost staunched.

Fourth, major FDI inflows, like the $34 billion from Japan, have not started flowing in, and should get registered in the coming year, with progress on the Mumbai-Ahmedabad bullet train and the dedicated freight corridor (DFC) projects. China too should soon open its account in India with investments in some of India’s cities. That could trigger a major uptick in FDI.

Fifth, India is just beginning to reassert its uniqueness. Unlike other Asian tiger countries (including China) that are export led, India is likely to remain domestic demand led for at least a decade or two. So while FDI will remain a key indicator, the biggest fillip to growth will be domestic demand.

This is where the prime minister’s rural focus becomes relevant. He has two problems: (a) to set right a banking sector which is extremely wobbly at the knees. The Congress-led government has proved once again that it cannot be trusted with the management of public sector banks. It drove them to the ground in the 1980s with its loan melas, and then repeated this during the last decade with the double whammy of loan write-offs and crony capitalism loans and largesse. (b) to find a way to make the power sector vibrant again. This will mean compelling states to reduce their reckless power subsidies. That explains why the Union government has steadfastly refused to allow loan write-offs in Andhra Pradesh, Telangana and now in Maharashtra, notwithstanding irresponsible politician-led demands. You don’t create a healthy economic environment by teaching the most honest borrowers to become dishonest and not repay bank loans.

That is why Modi has embarked on a two-pronged strategy. Focus on rural income growth. But don’t forget infrastructure.

He knows that it is easier to grow rural incomes than it is to grow city incomes. What agriculture needs is to marginalise rapacious middlemen on the one hand, and do the little market infrastructure bit to make farm output more saleable and less perishable.

Encouraging more milk cooperatives in Uttar Pradesh, Jharkhand, Punjab, Assam, West Bengal and later in other North East states is one way. Remember that good cooperatives pay farmers at least Rs.26 a litre for 300 days a year. Middlemen pay them just 14-24 a litre. Also note that even though India is the world’s largest producer of milk, barely 25% of the milk is handled by the organised sector.

This will compel middlemen to pay higher prices to farmers. That could kickstart rural income growth, because dairy farming has the potential of creating a surplus of Rs.100 per cattle per day for 300 days a year for marginal farmers. Watch the moves of Amul (GCMMF) and NDDB on this front.

Also, track NDDB’s efforts to replicate such price support and marketing structures for pulses and vegetables (more on this later). That could further add to rural income growth. Coupled with increasing investments in food processing facilities there could be a resurgence here.

Growing rural incomes will catalyse demand for consumer products, vehicles and textiles among other things. By that time, some of the new roads and railways should be in place, providing a multiplier effect to economic growth.

How Modi kickstarts his coastal development programmes has yet to be seen. But you can be sure it will add to the overall growth story. Together, they could bring in tourist dollars, and create more jobs.

But three things could spoil these plans. First, the shrill cries against traders of cows might scare people away from the dairy sector. Such disruptive forces need to be stomped out.

Equally worrying is the inability of States like Maharashtra to scrap the Agriculture Product Marketing Committees (APMCs). They have been parasites and have sucked money away from farmers and fattened the politicos. Maharashtra’s agriculture budget is a joke if the APMCs are not abolished.

Third, reckless drawing of water from the ground could destroy farming and soil fertility. Contain this by metering power for rural users (Maharashtra’s infamous cooperatives are some of the most reckless power consumers and loan defaulters). Build more check dams the way Gujarat did (Gujarat saw its ground water tables rise).

PM Modi’s economic vision is all right. What needs to be modified is the social vision. If that remains unchecked, his economic vision could run aground.

COMMENTS