R N Bhaskar

11 May 2015

The need for an industry-friendly land-acquisition law is underscored when one looks at Sabharwal Food Industries (SFI). This 5,000 tonne multi-commodity cold-storage unit at Kundli, Sonepat, Haryana is unique because its managing director, Anil Sabharwal, decided to re-engineer his plant, in partnership with Danfoss Engineers, so that the entire cooling system was vertical, not horizontal.

It was the classic example of Indian innovation (desi jugaad). “It saved us that much of land space, hence cost” explains Sabharwal. Cold-storage units are conventionally sprawled out. But given the demand for, and the price of, land this is proving to be increasingly difficult.

True, this land is meant for industry. But it is also ensures that the farmer gets higher prices for his produce. Without cold-storage units and good roads needed by refrigerated (reefer) trucks – the farmer would lose out. And so would the city dweller. Industry players also know that without modification in the laws governing land acquisition, purchasing land will only become extremely difficult and expensive.

Sabharwal’s unit is significantly different in many other ways as well. It is one of the first Indian units designed to use renewables as coolants, unlike many that use agents like CFC which is now being phased out. The most common renewable coolants are ammonia and carbon dioxide, both environment-friendly. Further, SFI is a multi-product unit, unlike most cold-storage units in India. It points to the way such units in India could get designed in the future.

Most cold-storage solutions in India are single-product facilities. You can find them for bananas in Tamil Nadu, and for grapes in Maharashtra. Most of these are farmer-owned. As a spokesperson of the National Centre for Cold Chain Development (NCCD) puts it, “Most players 67% of cold-stores are focused on single commodity storage for crops like potato, chilly and apples and are designed to support price arbitrage across lean periods and [also enable] commodity trading.”

Obviously, multiproduct cold-storage units are a lot more complex to build, and require skill to maintain and operate. They have to cater to a variety of requirements – ice-cream needs to be stored at minus (-) 25 temperatures. And as product volumes change from time to time, the best storage units are those where these chambers are flexible and can be modified with ease to cater to the exclusive requirement of each product.

Yet, the returns for this industry are getting better than ever before. First, there is more power availability, even though most units in India have still to bear the additional cost of standby generators and inverters. Second, the government too has become quite proactive towards this industry.

Value-added-tax (VAT) on cold-storage units has been removed. The subsidy element has been enhanced. That ensures that such enterprises can manage a return on investment of around 25% at least.

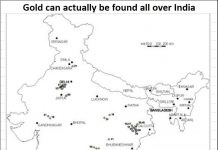

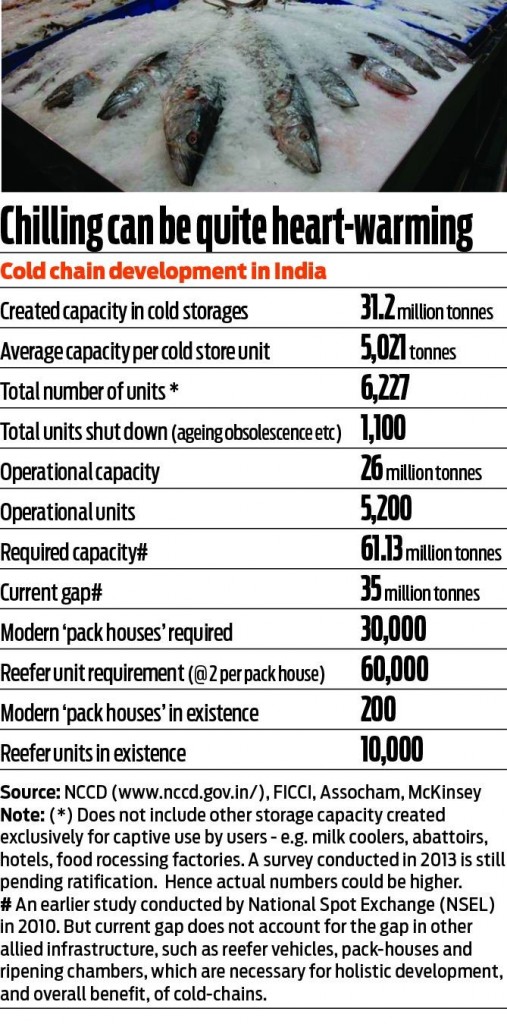

The potential for growth is immense. As the table alongside shows, the current market gap is for 35 million tonnes, against an installed base of just 25 million tonnes. And this gap is slated to increase.

With more urban cities being planned – the government has announced an outlay of over Rs2 lakh crore for upgrading existing towns and cities to smart cities the demand for cold-storage units will only increase. After all, large cold-storage units are best located on the periphery of large towns, where there is a huge demand for all kinds of perishable consumables – from ice-cream and other milk products to fruit and vegetables.

This urbanisation will also trigger further demand for special refrigerated trucks and wagons (reefers) which in turn transport the produce from cold-storage units to the consumption retail outlets. That will translate into a demand for better roads and better connectivity by rail and port. Expect the cry for land to become shriller.

The demand for cold chain solutions will also be galvanised by the government’s own focus on horticulture. After all, most farmers are holders of small parcels of land. Many prefer growing vegetables because they provide a cashflow every 23 months. This is unlike cereals and fruit which often offer a yield once in six months and at times once a year. But vegetables are perishable. Without preservation facilities (and at times even the ability to take them to more lucrative markets) the farmer loses out.

Horticulture makes sense for another reason. Vegetables account for 39% of land but 47% of value from agricultural produce. Fruit accounts for 29% of the land but 24% of value. Flowers take up just 1% of the land but contribute to 23% of the value. Plantation crops and even wheat and rice offer lower returns. But the latter enjoy more political clout and hence manage to corner more incentives and attention.

How big are agricultural losses because of poor cold-storage facilities? Frankly, nobody knows for certain, because there has been no serious survey on this subject. A 2012 report by CIPHET (Central Institute of Post Harvest Engineering and Technology, Ludhiana, India) estimates losses ranging from 6%18% in selected fruits and vegetables. But the report does not factor in analysis of the losses that can be directly attributed to lack of cold-chain.

A McKinsey report, however, puts the loss around 35% (US$52 billion). But government sources contest this and expect losses to be around 1520%. The 35% figure appears plausible considering that, globally, losses have been in the region of 35%. Since India has yet to develop its cold-chain solutions across the farming sector, it is unlikely that losses could be lower.

To minimise such losses, the cold-chain industry wants the government to provide incentives for building a Reefer Vehicle Call-in-centre. The idea is to provide a toll-free number for all perishables transport. Any transporter can call this number to redress situations faced on the highways, including extortion, delays and bottlenecks.

But the biggest bottleneck will be the artificial barriers state government erect in the transportation of agricultural produce. One such barrier is the notorious APMC (Agricultural Produce Market Committee), where state representatives become extortionists. While this has been abolished in states like Gujarat and Delhi, some states like Maharashtra have yet to abolish it.

But with the clamour for free movement of agricultural produce growing, expect such barriers to get phased out soon. That, in turn, will mean a further increase in demand for cold chain solutions.

The author is consulting editor with DNA.

Read the original article here.

Click here for more India and its policies.

COMMENTS