The brittleness of impatience crackles. There is the familiar irritable fretfulness of politicians and industry captains as they chafe against the RBI’s reluctance to ease interest rates a bit more. Unspoken, yet unmistakably implied, is the accusation that the RBI is playing spoilsport.

But, the truth is that many Indian politicians and industrialists are the ones to be blamed. They have behaved like spoilt brats. Both have connived to pauperise Indian banks under one excuse or the other.

The politician did this with his doles of largesse. Remember, they are primarily responsible for the annual loss (theft?) of electricity worth Rs 85,000 crore. Their policy of subsidies has bankrupted state distribution companies (discoms) causing unpaid bills of Rs1.9 lakh crore (both figures from Crisil’s July 2015 report Current Worries). Industry, on the other hand, has taken loans recklessly knowing that their politician friends would lean on banks to make these advances even in the face of lending risk. That explains why India’s public sector banks have, according to a Credit Suisse report, witnessed troubled loans rise to 12% of disbursements compared to just 4% for private banks. In fact, public sector banks account for more than 70% of India’s loans. The mounting bad debt now demands that these banks get around $40 billion of fresh capital by 2018 just to conform to internationally agreed rules on minimal capital standards. This is a subsidy for the rich, by the politician class.

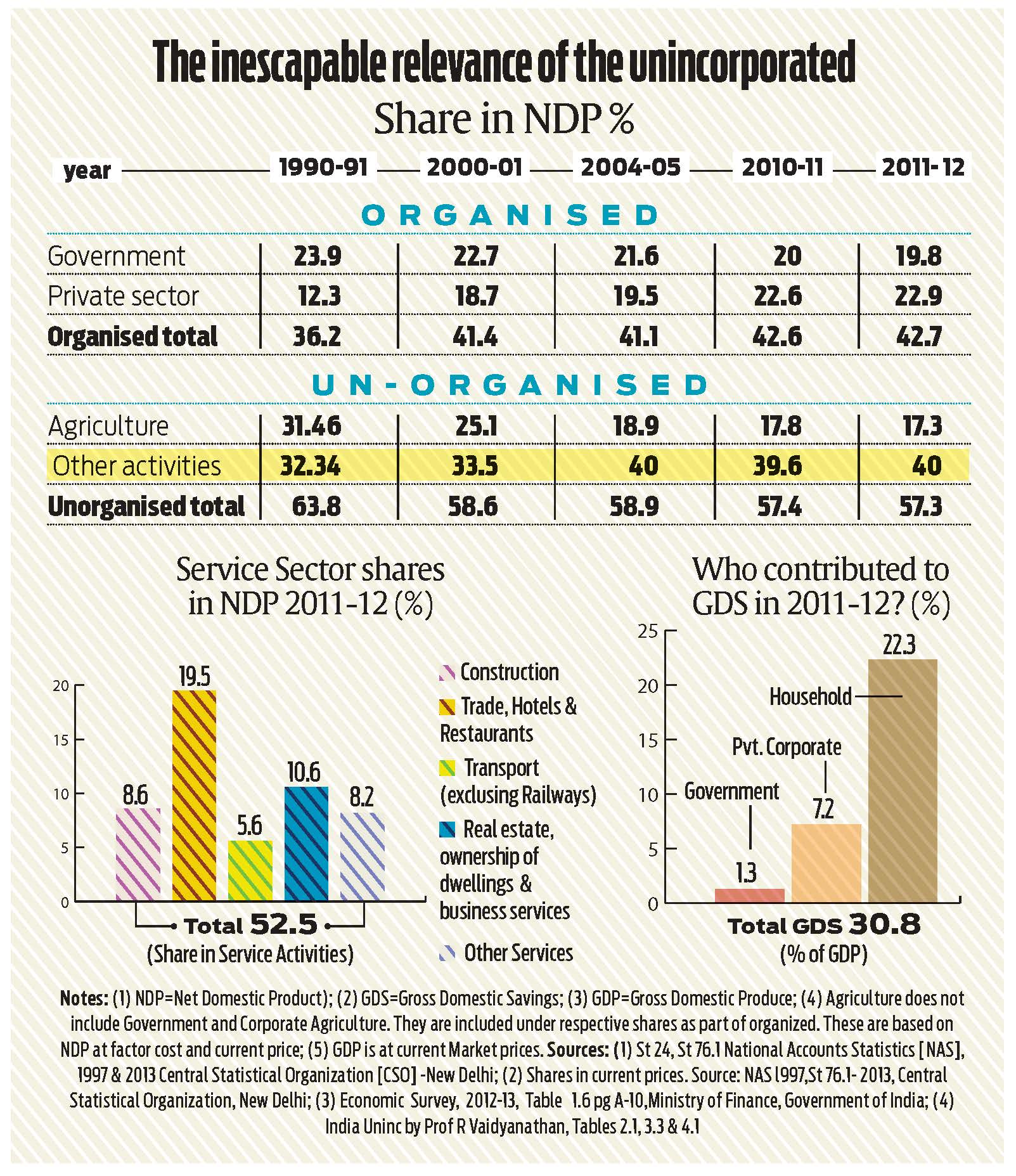

But look beyond the spoilt brats, and you will discover a vibrant unincorporated sector which the government often (and wrongly) refers to as the unorganised sector. Unlike the private corporate sector, which accounts for a 30% share of India’s GDP, the unincorporated sector accounts for a bigger share of 40% (see chart).

Most of these “unincorporated” businesses (a term borrowed from R Vaidyanathan’s book India Uninc) are into services like construction, transport (excluding the railways), real-estate and trade. But even here, the organised private sector accounts for just a 12.5% share, if one takes away the 40% that comes from the unincorporated sector.

Most of the workforce in this sector works on a contract basis, without the comfort of gratuity, medical reimbursement, or provident fund, as Prof Vaidyanathan pointed out in a recent talk organised by Moneylife Foundation. That is why, the government’s recent move to provide pension and insurance to such people at very nominal rates of premium is a welcome step.

Read: PM Modi launches social security schemes for insurance, pension

Unlike the organised sector, this sector has to make private arrangements for capital — often paying at least 2% as interest per month. Bad debts are very few, unlike those faced by the nationalised banks. And as long as the politician does not intervene, even micro-lending financial institutions enjoy significantly higher debt recovery rates than nationalised banks. (Read: The Janus-headed nature of bad debts, and it’s just getting scarier) .

The RBI’s interest cuts mean little to the unincorporated sector. Loans are taken against gold, small assets, and personal standing in the community. Loans are repaid, because the collection mechanisms are far more demanding than the banks that politicians love to control. For proof look at the way cooperative banks (mostly controlled by the politician class) had to be bailed out year after year.

There are other differences. The private sector uses lawyers and its politician friends to protect its interests. And the government machinery is mostly beyond scrutiny or prosecution. That explains why much of the extortion by sales tax inspectors, police, food and drug inspectors and employees at octroi-checkposts fleece this largely unprotected unincorporated sector. That this sector survives, despite the exploitation, is testimony to its business savvy and innovative approach to business.

Surely, if there is any part of the Indian economy that needs incentives, it is this sector. After all, it has been the largest contributor to gross domestic savings in the country — far more than the government or even corporate plough-back of profits.

However, it is also quite possible that much of this sector’s strength is on account of the organised sector’s growth. Remember how the market for construction workers, drivers, meal providers, pubs and malls surged with the growth of the organised BPO and retail (business process outsourcing) sectors. It is quite possible that the manufacturing sector will spawn even more small businesses than the service sector — ranging from scrap collectors, vendors, transporters, to people who provide for housekeeping, security, and a variety of other jobs. However, what the unincorporated sector needs is the government’s help in easing the ruthless exploitation of its people by predatory petty inspectors of all types. One way is for the government to do away with its ‘rationed’ approach towards hawking, vending food, and a variety of items. Allow for more hawking plazas, with enough vending slots for anyone who wants to be there (in proximity to both work and residential areas). Dismantle the inter-state barriers inhibiting free movement of goods. Ban illegal parking by creating parking plazas . Incentivise electronic transactions and banking. These could help shrink the bribe quotient paid by this unincorporated sector. Related Read: A recipe for decongesting Mumbai and Delhi

But this requires immense political will. After all, a percentage of almost all bribes — by police, sales tax, shops and establishment, octroi, excise and food and drug inspectors — goes to elected representatives. They are the ones who turn a blind eye to such a cancerous growth. They are the ones who do not want good legislation to be put into place.

Can the situation be ameliorated? Yes. Just two simple moves could trigger major changes. Watch this space next week.

COMMENTS